Tariff duty drawback emerges as a pivotal component of international trade, significantly influencing economic relationships and fostering global commerce. This financial mechanism is not only an economic instrument but also a subject of deeper contemplation when viewed through the lens of Christian principles. In this exploration, we will dissect the essence of tariff duty drawback in relation to Christian ethics, its implications, and the reasons behind this intricate connection.

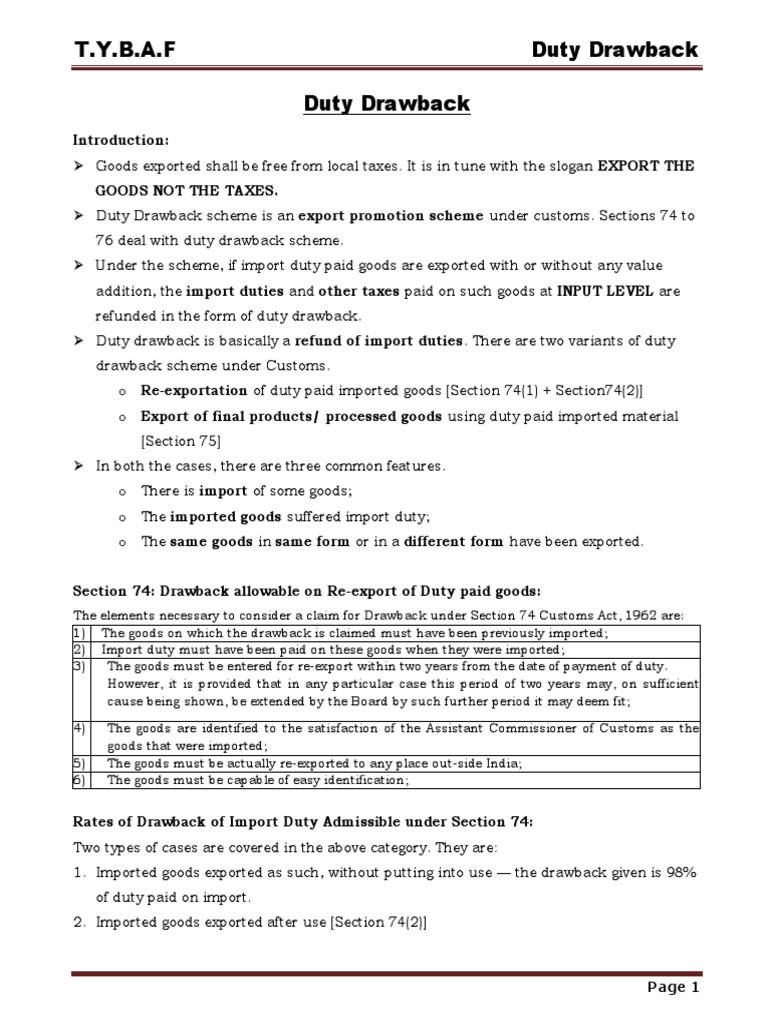

At its core, tariff duty drawback refers to the refund of customs duties that are levied on imported goods when they are subsequently exported out of the country. This arrangement aims to stimulate trade by alleviating the financial burden on businesses that operate in a global marketplace. However, the implications of this practice extend beyond mere economics; they touch upon fundamental Christian teachings regarding stewardship, fairness, and integrity in dealings.

In scripture, the notion of stewardship is paramount. Christians are called to be good stewards of the resources entrusted to them. This principle extends to the economic realm, where the motivation behind seeking a tariff duty drawback can be scrutinized. Companies may pursue these refunds not simply for profit maximization but to ensure they can reinvest in their communities and contribute to the common good. This approach aligns with the biblical imperative of caring for one’s neighbor and fostering a spirit of generosity.

Moreover, the interplay of duty drawbacks and Christian doctrine raises questions about the nature of fairness in economic practices. The gospel calls for a society that reflects equity, where every individual is treated with dignity and respect. Critics of tariff duty drawback may argue that such policies favor larger corporations, enabling them to navigate tariffs more easily than smaller businesses. This possible disparity can lead to a perception of injustice, thereby challenging Christian aspirations for a just society. It begs the question: how can tariff systems be structured to promote equitable outcomes while still supporting economic growth?

Furthermore, considering the biblical theme of integrity, one cannot overlook the ethical dimensions surrounding tariff duty drawback. The complexity of international trade often leads to intricate paperwork and compliance regulations, creating opportunities for dishonest practices. In a scenario that involves seeking refunds for duties, the pressure to bypass ethical standards may arise. Christians are called to uphold integrity in all aspects of life, including business. Thus, the pursuit of duty drawbacks must be approached with a commitment to honesty, ensuring that all claims are legitimate and principled.

Additionally, one must reflect on the concept of community within the Christian worldview. Tariff duty drawback can be perceived as a tool that, when wielded responsibly, enhances the economic health of local populations. Exporting goods creates jobs, supports local economies, and can elevate standard living conditions. From a communal perspective, businesses that effectively utilize tariff duty drawbacks can have a more substantial impact on their communities, thereby reflecting the biblical principles of providing for the less fortunate and enhancing communal well-being.

Another crucial dimension is the theological implications of trade and economics. Christianity has evolved alongside global commerce, and the doctrine of Creation offers a profound commentary on our economic interactions. In Genesis, humans are appointed as stewards of creation, emphasizing responsible management of resources. Thus, when a business engages in trade and seeks tariff duty drawbacks, it is reaffirming its role as a steward within the overarching framework of societal well-being. This stewardship should not be taken lightly, as it has far-reaching consequences on how resources are allocated and how wealth is generated and distributed.

Discussions around tariff duty drawback also prompt reflections on the global interconnectedness emphasized by Christianity. The story of the Good Samaritan epitomizes the call to recognize our shared humanity, transcending geographical boundaries. Through the lens of this parable, the implications of export and import duties draw our attention to the moral obligations we have towards others, especially those affected by our economic decisions. Businesses that practice structured responses to tariffs while seeking duty drawbacks can find themselves at a crossroads of ethical practice that affects global trade dynamics.

In conclusion, the concept of tariff duty drawback invites contemplation not only about its economic ramifications but also about the broader ethical and theological implications within a Christian context. It prompts an exploration of stewardship, equity, integrity, and community in business. As the complexities of international trade grow, so too must the Christian reflections on these practices. Businesses are called not only to navigate the intricate regulations of tariffs but to do so in ways that honor their commitment to living out Christian values. In this sphere, understanding the deeper motivations behind engaging with tariff duty drawbacks allows for both economic thriving and a faithful witness to the teachings of Christ.