In the intricate landscape of social services, understanding the myriad acronyms can often leave individuals and families perplexed. Among these terms, “IRT” emerges as a crucial concept within the realm of CalFresh, California’s Supplemental Nutrition Assistance Program (SNAP). But what is IRT, and why does it matter to those navigating the complexities of food assistance?

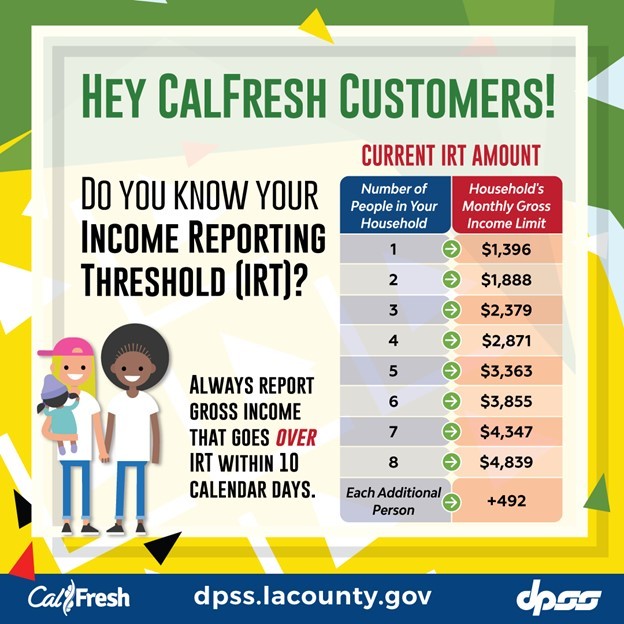

IRT stands for Income Reporting Threshold. Essentially, it functions as a benchmark that determines how often households enrolled in CalFresh need to report their income. For many families, understanding this threshold can lead to significant implications for their benefits, their budgeting practices, and overall food security.

To comprehend the significance of IRT, one must first explore the fundamental role of CalFresh itself. CalFresh is designed to alleviate food insecurity by providing monetary assistance for purchasing nutritious food. However, eligibility for assistance is not a static factor; it fluctuates based on income levels, household size, and additional circumstances. This is where IRT comes into play.

IRT is crucial for maintaining the integrity of the program. It safeguards against fraud and ensures that benefits are allocated to those who need them the most. When a household’s income exceeds a certain level—defined by the IRT—the family must report this change to the CalFresh office. This aspect alone highlights the importance of awareness around IRT, as unreported income can result in overpayments, leading to debt and potential sanctions.

It’s essential to acknowledge the specifics surrounding the Income Reporting Threshold. The IRT can vary based on household size and specific demographics. The state periodically reviews and updates these figures, adapting to economic conditions and ensuring that the thresholds reflect the current cost of living. This nuanced approach demonstrates a commitment to both accountability and compassion, adapting to the realities that families face in California.

One of the most significant shifts in perspective that understanding IRT provides is the recognition of its potential to affect household budgeting. For families receiving CalFresh benefits, being proactive about income reporting can prevent the unintended loss of assistance. Misunderstanding the IRT might lead to complacency, where families believe their income status is stable. However, fluctuations in work hours, job changes, or unexpected expenses can all impact eligibility. Thus, being cognizant of IRT encourages a more strategic approach to family finances, inviting households to continuously assess their financial situations.

In navigating the implications of the IRT, it’s also important to address the practicality of reporting income. Households must report when their income exceeds the threshold and also in situations where they experience a decrease in income. This reporting provides an opportunity for families to reevaluate their eligibility, perhaps qualifying them for greater assistance as their financial situation changes. This duality emphasizes a reactive element in managing benefits, where staying informed can yield advantages in times of economic uncertainty.

As individuals delve deeper into the realm of CalFresh, it becomes evident that the program extends beyond mere financial assistance; it is a pathway to dignified living. Understanding the nuances of IRT is akin to possessing a key that unlocks further resources. It serves as a vital tool that empowers families to make informed decisions about their health and nutrition. Maintaining open communication with local CalFresh representatives and utilizing available resources can enhance families’ understanding and ultimately lead to improved life outcomes.

Another critical component of the discussion surrounding IRT is its role in fostering a culture of transparency. By requiring regular income reporting, CalFresh cultivates a sense of accountability among recipients. Families are encouraged to actively engage with the system rather than passively receive assistance. This engagement can significantly alter perceptions of food aid—from viewing it as a mere handout to recognizing it as a service intended to support one’s path toward self-sufficiency.

Moreover, as we address the operational side of IRT, it is fundamental to discuss the potential technological advancements. The digital age offers unprecedented opportunities to streamline the reporting process. Electronic benefits transfer (EBT) systems and online platforms could simplify income documentation and reporting, making it easier for families to navigate their requirements while reducing administrative burdens.

In conclusion, IRT serves as a pivotal concept within CalFresh, intricately tied to the broader goal of alleviating food insecurity in California. Understanding income reporting thresholds holds the potential to transform how families perceive food assistance, shifting perspectives from being passive recipients to proactive participants in their welfare. This knowledge not only influences budgeting strategies but also enriches the shared narrative of resilience, empowerment, and self-sufficiency among communities. As more families become aware of their rights and responsibilities within the system, the future can be one of sustainable, nourishing food choices rather than mere subsistence.

Ultimately, the journey through the complexities of income reporting thresholds invites a broader conversation about food justice and equity—topics that resonate deeply within every community. Understanding IRT within CalFresh is not just a matter of administrative compliance; it is an invitation to be part of a collective movement toward a more equitable society. As knowledge and empowerment take center stage, we can anticipate a brighter future where food security is a fundamental right, accessible to all.